# import libraries

import yfinance as yf

import numpy as np

import matplotlib.pyplot as plt

from scipy.stats import norm

# download price history

AAPL = yf.download('AAPL', start='2022-01-01').Close

plt.figure()

AAPL.plot()

# calculate returns

rets = np.log(AAPL/AAPL.shift(1))

rets.dropna(inplace=True)

plt.figure()

rets.plot()

plt.figure()

plt.hist(rets,50)

# fit normal distribution

mu, std = norm.fit(rets)

x = np.linspace(-1, 1, 100)

p = norm.pdf(x, mu, std)

plt.plot(x, p, 'k', linewidth=2)

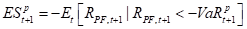

# calculate next day VaR and ES

h = 1

alpha = 0.01

CVaR = alpha**-1 * norm.pdf(norm.ppf(alpha))*std - mu

VaR = norm.ppf(1-alpha)*std - mu

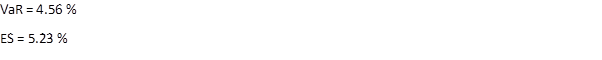

print('VaR = %2.2f %%'%(VaR*100))

print('ES = %2.2f %%'%(CVaR*100))

Have questions? I will be happy to help!

You can ask me anything. Just maybe not relationship advice.

I might not be very good at that. 😁